What a month it’s been for AI search technology! After almost a year of testing in labs, Google took the step we were all waiting for and began rolling out AI more broadly across search. One week prior to this, based on our BrightEdge Generative Parser™ data, we correctly predicted that Google was getting ready to launch SGE at Google I/O.

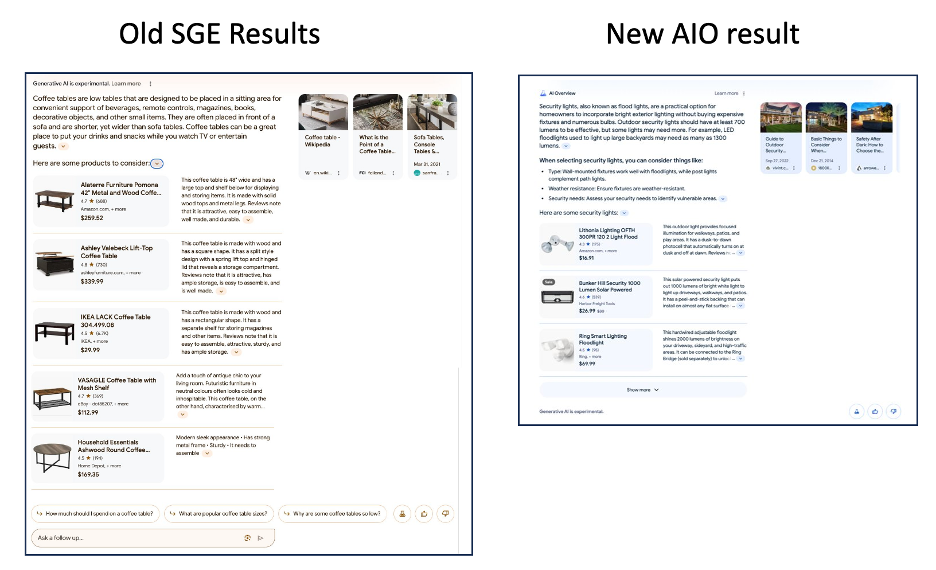

According to Google’s guidance, this replaces Google’s Search Engine Experience (SGE) for those who have been enrolled in it through Google labs.

AI Overviews are built on the same Large Language Model (LLM) as SGE, and BGP is able to track their presence just as it did with SGE. AI Overviews are included to US users who are logged in to Google, regardless of whether they’ve enrolled in the Google Labs, but as of this writing are still not available to any non-logged in users.

This is still very early days as we’re only two weeks into the era of AI Overviews, but I’d like to share some data BrightEdge Generative Parser™ is collecting that tells us a bit about what’s happened since the launch. For SEOs and Digital Marketers looking to realize the opportunities that Generative AI Search offers, there are some important insights about what we could expect!

Here are ten findings that our data helped uncover about AIOs and how they differ from how Google has been testing SGE.

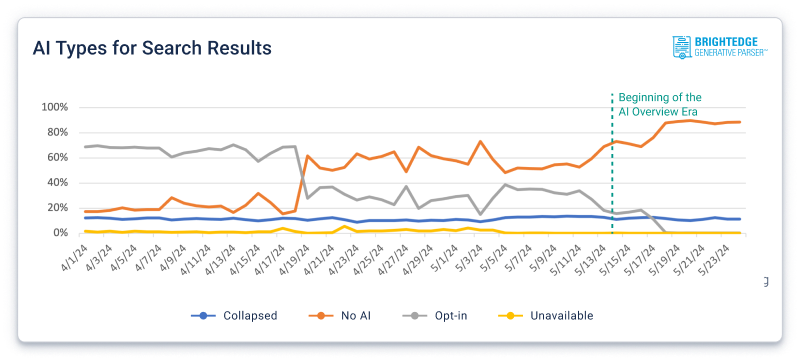

1. Google went from showing AI on 84% of queries to 15%

We noted that SGE started showing for significantly fewer queries back in April and that trend is continuing in the era of AI Overviews. AI Collapsed results have remained present and stable but AI Opt-In results are now close to non-existent for AI Overviews. This one change explains the decrease from 84% to 15%.

Overall, BGP detects that Google is getting more precise on what queries are best to deploy AI.

2. AIO provides more information that doesn’t overlap with traditional results

In these early days of AI Overviews, we’re seeing a trend to complement traditional results which helps answer multiple queries in a single result. In fact, when AI Overviews replaced SGE, we saw this metric jump significantly:

In Google’s official product release blog, they describe Generative AI in Search as a vehicle to “Let Google do the searching for you”. This makes sense. Why would it give you the same results you’re already seeing in traditional search? Its role is to do the 2nd, 3rd, and 4th search you may do.

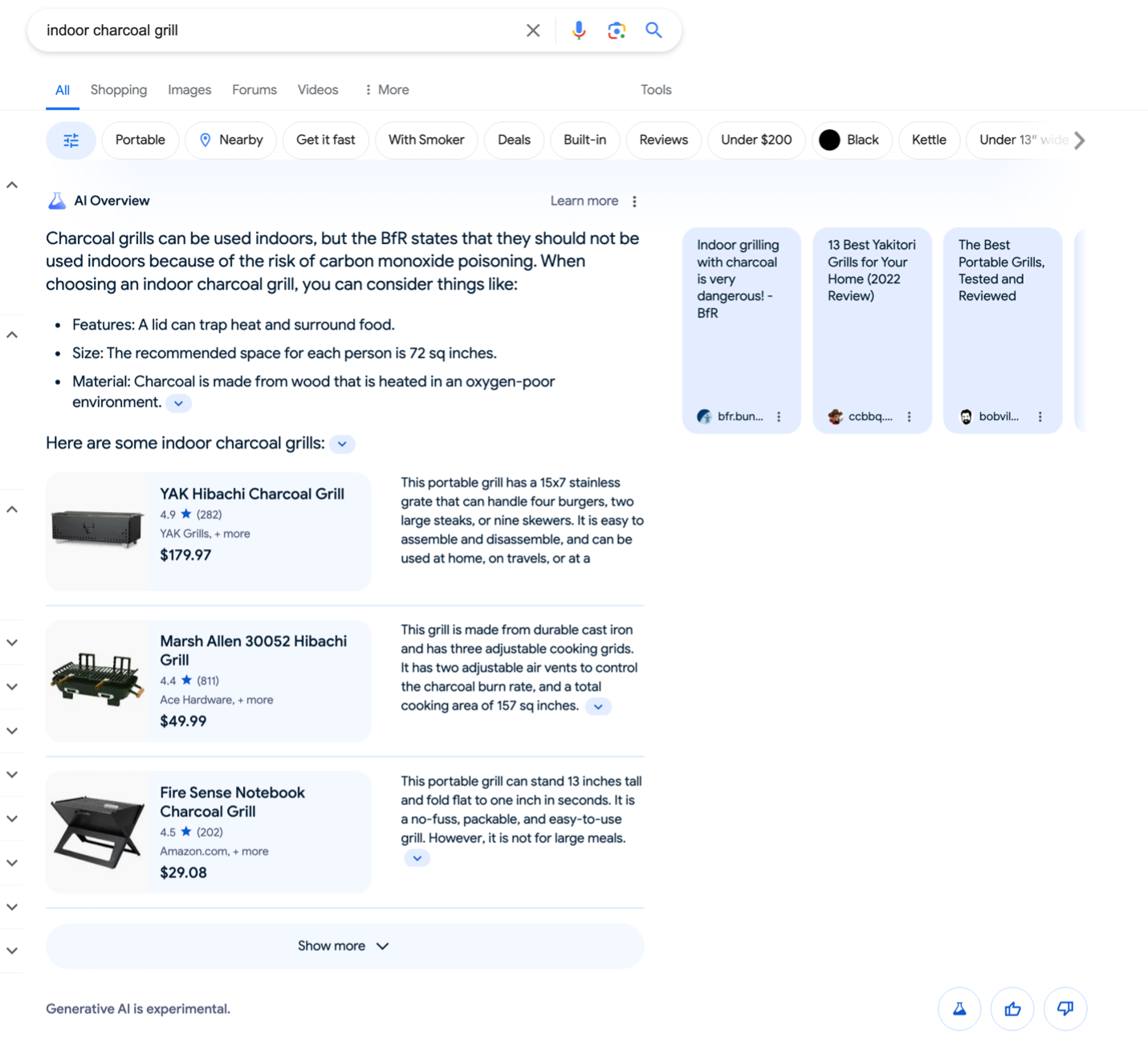

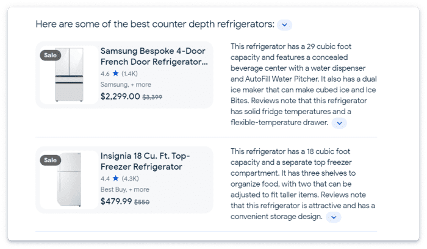

For example, take this query for “indoor charcoal grill”:

Here we see that the AI Overview is already anticipating that somebody searching for this might likely also need to search on things like “Best size for an indoor charcoal grill,” “Are indoor charcoal grills safe?,” “What is a charcoal grill made out of?” and so on. It factors that into an original generative AI response for that user. As a result, we see that its citations are not necessarily going to be from things that would be as relevant in a search result for the original query. This phenomenon represents a fantastic opportunity for digital marketers and SEOs who want to drive traffic from search. Now, you have an AI assistant who’s already anticipating queries your customer might have before they even make them. If you are focused on all the nuances of topics you need to win on, you have an opportunity to go even higher in the decision funnel with your customer when AI overviews are present.

Our guidance remains to optimize a topic as opposed to a keyword will help more of your content not only rank for traditional search but also serve as a citation for the AI overview.

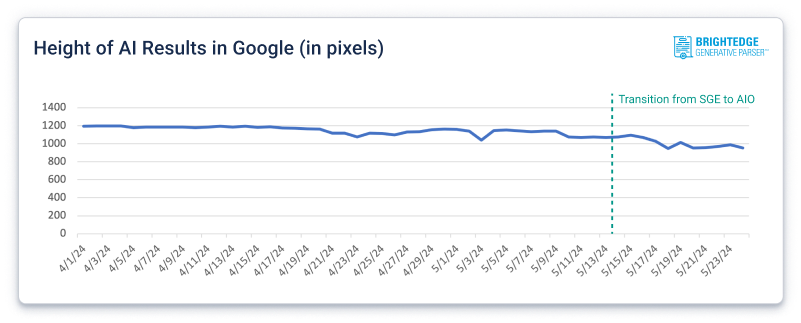

3. AI Overviews are even smaller than SGE

For the past two months, we’ve observed SGE results taking up less and less space on the search results page. When AI Overviews rolled out, we saw them significantly drop again. This is likely because Google is figuring out what is important to be included in AI results:

Today, AI Overviews are 30% smaller than SGE results were at the beginning of May. We've suspected this size reduction is the result of Google testing and learning what modules are most effective for users and eliminating those that are not. As AI Overviews roll out broadly, it'll be important to get this right to ensure search experiences are as useful as possible.

For websites already doing well with SEO, this is good news because it means AI Overviews are less likely to crowd out organic results. Instead, Google is getting better at serving two audiences simultaneously: those who want AI guidance and those who know exactly what they want — all in a single search result!

For digital marketers thinking about the topic the query represents, this means you have opportunities to reach people in multiple mindsets all in a single session. For users, this is an opportunity to find the right content more quickly and efficiently.

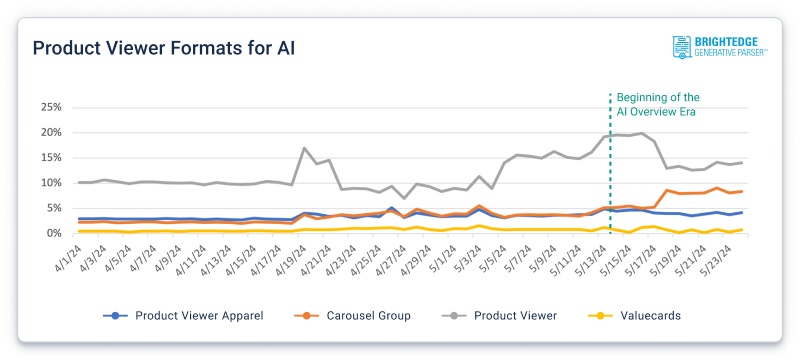

4. AI Overviews are deferring to more efficient modules

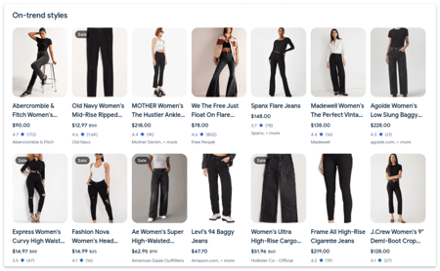

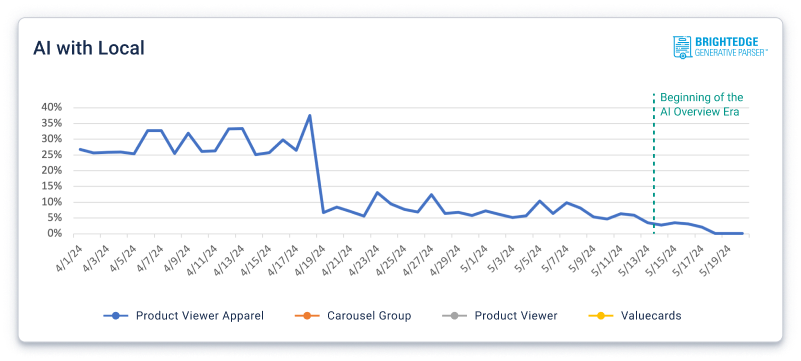

E-commerce is one area where we see AI Overviews appearing more frequently (1 in 5 queries for logged-in users). For most of the SGE period, general product viewers were by far the most common product display module to appear.

When we moved into the era of AI Overviews two weeks ago, almost right away, we saw these types of results decline in visibility and carousel-oriented results began to rise.

Now, carousel groups are on the rise. If this trend continues, we may see these two evenly distributed in the next month. Given Google's announcement of ads for AI Overviews, the carousel format is an ideal way to display the results since they are very similar to shopping carousels.

For digital marketers and SEOs, the shift to more carousels in AI Overviews aligns with the trend of decreased pixel depth. This format allows for the display of more products in less space, offering vendors increased visibility and opportunities to appear in search results. The carousel format accommodates more products within the limited screen space, maximizing exposure for various vendors. Additionally, the integration of paid strategies and organic results becomes more crucial as AI overviews enable users to accomplish more with less screen space. The coordination between paid and organic efforts ensures that users can easily find and access relevant products, enhancing their overall search experience.

5. Modules that are transactional have been deprecated

At one point during SGE, the "Places" module was very common in search results. In fact, for a period in January, it was the most common module to appear. However, within days of rolling out AI Overviews, the "Places" module disappeared completely.

Given that Google states the mission of AI Overviews is to help users explore a topic further, it makes sense that the "Places" module may no longer be necessary. The module itself offers few details that can't already be found in the local pack. In addition, there isn’t much value added by Generative AI.

The disappearance of modules like "Places" suggests that Google AIOs are less likely to show content already present in organic search results or be present when Generative AI does not significantly improve the search experience.

6. Elements in traditional search correlate to the likelihood of an AI Overview appearing.

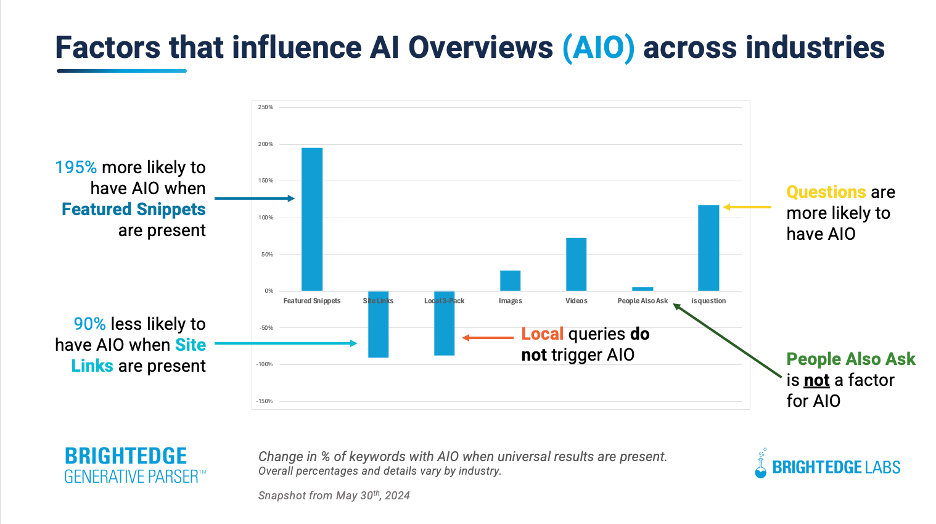

Beyond these macro trends, BGP has also detected some interesting correlations and conditions specific to industries. By cross-referencing BGP data with organic search data from Data Cube X, we have identified correlations between the presence of AI Overviews and attributes occurring in traditional searches:

We can see that Featured Snippets and whether or not the keyword is a question are the most likely conditions to correlate to an AIO. Conversely, we are seeing that the presence of site links (typically brand queries) and the local pack have a strong negative correlation to AIO. This aligns with how Google has described the role of AIO. That is to say, they are meant to help users when it is determined they may want to explore the topic further. With brand queries and local packs, these are navigational and transactional queries predominantly. As a result, there are fewer reasons for AI Overviews.

For marketers, this is a very critical insight. Isolating your keywords where a question is present and where a featured snippet is present are most likely to feature an AIO. Armed with this information, you can now plan your optimization strategy to serve both the mindset in traditional results and those that may be triggered from AIO.

7. AI Overviews vary across industries

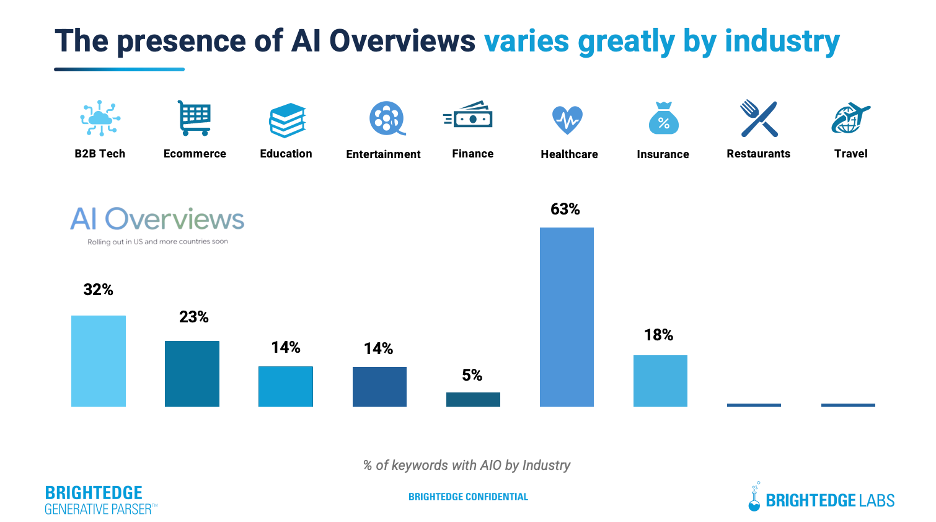

As I mentioned earlier, it’s apparent from the data that AI Overviews are being shown on fewer queries than SGE on average. However, this is not uniform across all industries. In fact, when we dig in, it appears some industries are far more likely to serve an AI Overview:

Other observers of AI Overviews have noted that, despite being a Your Money or Your Life category, Healthcare curiously returns a high number of AI Overviews in its search results. This was previously the case as well with SGE. We suspect this is because for health advice AIOs rely on expert opinions from highly authority sites such as mayoclinic.org, nih.gov, clevelandclinic.org to provide high quality answers. In addition, users looking for medical advice are likely to consult a professional for additional information before making a decision.

We also see that B2B Tech, Ecommerce, and Insurance are above average. Based on Google’s guidance on AIO, the goal is to help users with more complex queries. These categories may be ones where users are doing searches where more context is determined to be helpful.

8. Specific keywords in particular industries are more likely to trigger an AIO

BGP was able to analyze the nature of keywords that are currently serving AIO, and there are specific attributes that stand out across the industries we measured:

- B2B Tech: Currently, 32% of B2B tech keywords are showing AIO. Keywords that contain “vs” (comparing products/services) are even more likely to show an AIO.

- Ecommerce: On average, 23% of Ecommerce queries show an AIO. Queries related to Jewelry and Small Kitchen Appliances and more likely to show AIO, 45% and 35% respectively. That is to say, if you are selling jewelry products, you can expect right now, nearly half of your ecommerce keywords are likely to show an AIO.

- Education: We observed that on average, 14% of education keywords are showing an AIO. However, when the keyword contains the word “skills,” that likelihood jumps to 75%.

- Entertainment: BGP has detected the presence of AIO on 14% of the keywords tracked. We also noted that when the keyword has “best” in it, we see the presence of AIO jump to just over 40%. And when users are searching for actors or actresses from the golden age of Hollywood, that figure jumps to 60%. For modern actors or actresses, the percentage falls back to the average of 14%.

- Finance: Only 5% of keywords related to finance are showing AIO, which is similar to what we observed during the SGE testing. However, if that keyword is a question, the figure jumps to 45%. We also observed that if the SERP features a video, the likelihood of AIO jumps to 20%.

- Healthcare: This category already has a high likelihood of showing an AIO at 63% of queries showing them. However, when that keyword is a question, the figure jumps to 80%.

- Insurance: While far fewer of the queries BGP tracks in Insurance show AIO, it has a similar pattern as healthcare. The category only shows AIO 18% of the time; however, if the keyword is a question, that figure jumps to 50%.

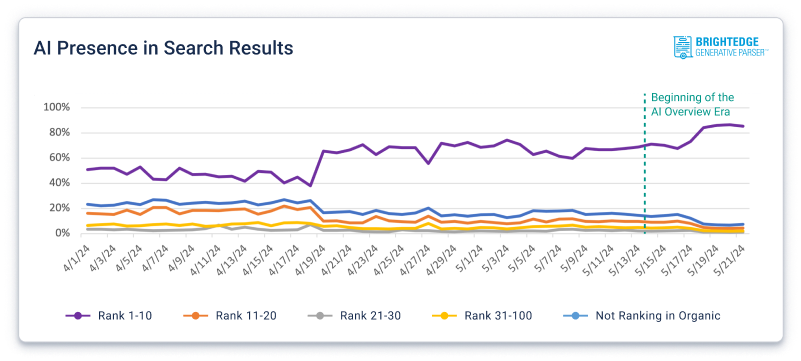

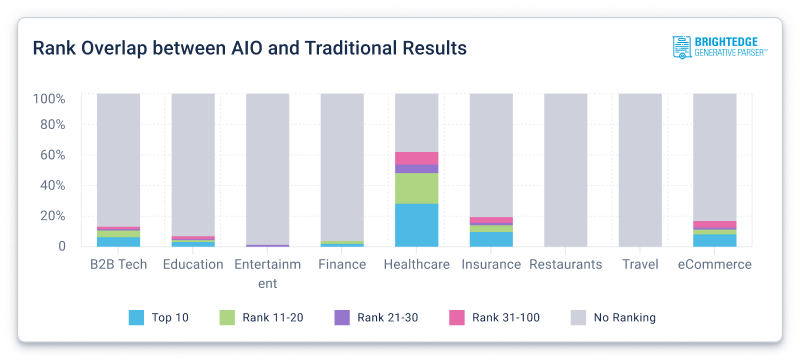

9. The rank overlap between AIO and Traditional Results is not evenly distributed across industries.

Across all keywords, we are observing that 85% of the citations in AI are not ranking in organic results. However, when we look at specific industries, we observe fluctuations in this metric:

For Healthcare, we see that one in four citations is also ranking in the top 10 results. This does correlate to what we know about Your Money or Your Life queries in that the category requires a higher degree of trust. Overall, it seems that Google treats this category differently than other industries. Conversely, we see that none of the entertainment citations are featured in organic results (and we are seeing very few AIOs in Restaurants or Travel). For marketers in these industries, it will be critical to monitor search result features such as Featured Snippets, as these could be indicators that AI Overviews may be coming to your keywords.

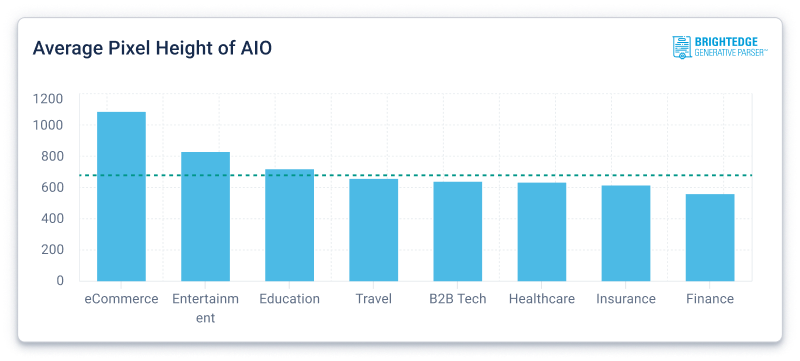

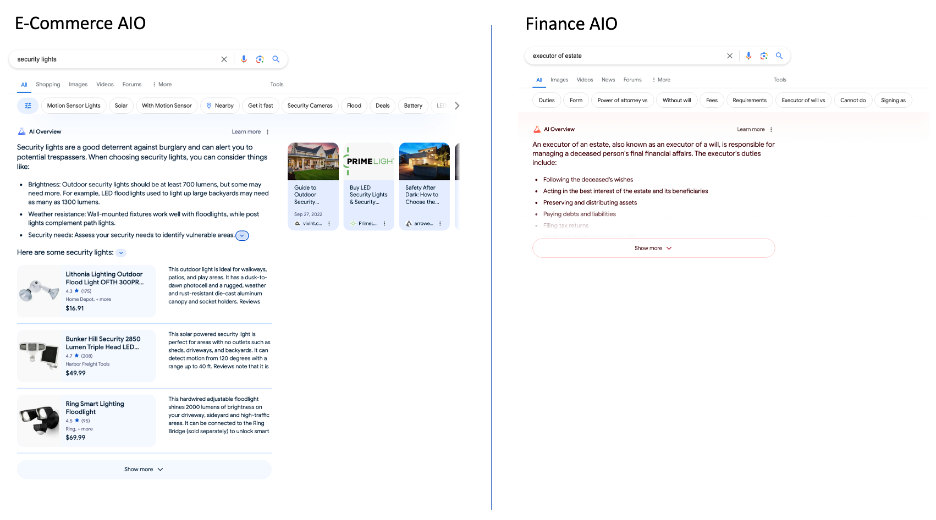

10. Ecommerce and Entertainment AIO results are the largest on the screen.

As I mentioned earlier, on average, we’re observing AIO is 30% smaller than SGE results. However, the size across industries varies. For Ecommerce, the size of AIO is still roughly going to occupy the space above the fold, whereas Finance queries are roughly half that size.

The difference in the space on the screen between these two results is striking when compared to each other:

As we can see, AIO not only provides information before a user clicks “show more” about Security Lights but also offers suggestions about products to consider. The Finance Query is strictly informational, featuring a typical unordered list that we see most often in AI results on Google. For Ecommerce marketers, this means that you may experience a greater impact from the presence of AIO than a finance marketer would. It is critical to identify where those attributes around the SERP features correlate to AIO in your industry to ensure you are planning accordingly.

What an exciting time to be in SEO! It’s fascinating to watch this rollout with BGP as we have a front-row seat to observe how Google is honing in on how AI can be most helpful to users. It’s apparent that AIO is being selectively deployed based on the intents in each industry. Furthermore, it’s clear from the ways AIO differs from SGE that they will work alongside other elements of the search result page to help users. For marketers, this presents a great opportunity to unlock new value and reach more mindsets from a single search!